Table of Content

Once the payment is completed, you will get a message for successful payment. You will also receive the BBPS bill receipt in email/ SMS/ print form and the transaction ID. A confirmation/ transaction success message will also appear on your screen once the transaction is complete. Check your transaction history for future reference.

The NRI has to submit the documents and the property-related documents when the loan is approved. The NRI home loan will be credited after the technical and legal staff from Axis Bank review it. The borrower can pay off the loan amount in advance. However, the applicant can repay the loan only if the tenure of the loan does not fall below 180 months. Those who are worried about the high rate of EMI need not anymore.

Overdue Loan Payments

The online repayment facility is available for Overdue Loan EMIs and Overdue Service Charges. The applicant can also apply for the home loan offline. They can go to the Axis Bank directly and then apply for the loan.

Individuals who have combined family income of family Rs. 8000 or Rs. 10,000 can apply for this loan. This lets the entire family contribute towards this loan. The loan can be used for a small house, which is 200 sq. The loan can be used to purchase a house that is under construction or which is on resale. The last 12 EMIs will be waived off in case the borrower has paid all the other EMIs on time.

Does the EMI amount remain the same throughout the loan tenure?

On the other hand, personal loan interest rates can range between 12 and 24%. Thus, you may feel like paying off your loan first since it can be of a longer duration as compared to your credit card dues. Always remember that the interest expense on credit cards can be exorbitant if you fail to make the payment on time. A business loan repayment schedule is a table of periodic loan payments which consists of the principal amount and the amount of interest.

Some lenders, however, are wary of giving loan to the elite class who fall under the HNI category. This is because they are borrowers of higher value and the bank fears about government security and regulations. The good news is that Axis Bank offers easy home loan to the HNI clients as well. They need to make sure that their documents are in place. The interest rate is affordable and suitable to meet the borrower’s repayment capacity. The loan amount that can be availed is maximum of 28 lakhs.

Super Saver Home Loan

CreditMantri was created to help you take charge of your credit health and help you make better borrowing decisions. If you are looking for credit, we will make sure you find it, and ensure that it is the best possible match for you. We enable you to obtain your credit score instantly, online, real time. We get your Credit Score online and provide a free Credit Health Analysis of your Equifax report. Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand.

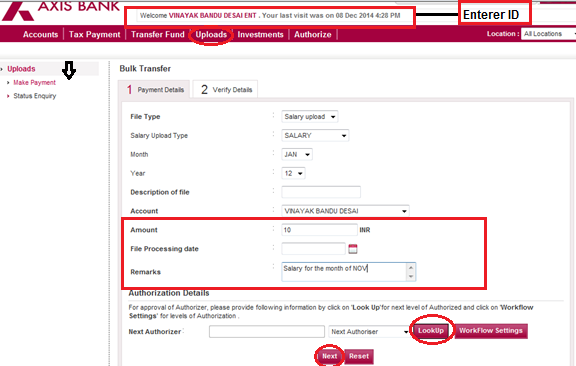

You can take the home loan either individually or jointly with a family member or close relative. AXIS Bank Home Loan EMI Calculator, the bank has made it easy for their borrowers to plan and compare various loan plans. Below is an example of how to obtain your loan number from your loan statements and enter it correctly into the Loan Number field when logging in to make an online payment. If you have a regular home loan from any other bank, consider a home loan transfer to Axis Bank opting for the QuikPay Home Loan.

Cover arranged by Axis Bank for its customers under Digit Illness Group Insurance Policy . Currently, the facility for pre-payment/part-payment towards loans is available only at Axis Bank Loan centres. We request you to reach out to your nearest loan centre for these transactions.

The existing home loan can be easily transferred to Axis Bank without any problem. The existing home loan can be easily transferred to Axis Bank without any problems. One can choose prepayment, and the bank will not charge any extra fees. Also, they can opt to transfer their old loan to Axis bank. As the payment years progress, it is seen that in the total EMI amount, the principal repayment amount keeps increasing, whereas the interest part decreases.

The amount will be credited to your Loan account within 3 working days. Only use PIN option if you don’t have an SSN on file with the bank. Invest surplus funds in the account to earn interest and withdraw whenever needed. FeaturesHome loan with overdraft facility to save total interest payable on your home loan. The partner banks for this service are provided in the dropdown.

AXIS Bank Home Loan interest rate starts at 6.9 percent. Just change the interest rates based on other banks and calculate the EMIs. You would effectively reduce the tenure of the loan by 9 years and save interest outgo of approximately Rs 25 lakh. Therefore, you need to assess the tax benefit you would stand to lose if you were to partly prepay the home loan. UseAxis Bank’s Home Loan Tax Saving Calculatorto get a sense of the income tax benefit you will be able to get against a home loan.

Loan tenure of 20 years can be availed in the case of fixed-rate loans. The bank charges a processing fee of up to 1% of the loan amount (Min. Rs.10,000) of which Rs.2,500 plus GST is required to be paid upfront while making the loan application. Axis Bank personal loan has zero foreclosure fees and the bank also has no part payment charges. A personal loan can be availed with quick disbursal and the bank allows flexible end-use of the same. Some of the common uses of Axis bank personal loan include funding for vacation expenses, home renovation, organising a dream wedding and finances related to medical emergencies. Axis Bank offers personal loans ranging from Rs. 50,000 to Rs. 15 lakhs with flexible repayment tenure of 1 to 5 years.

No comments:

Post a Comment